Building an Offline strategy for D2C

Post-read from the 90 minute Deep Dive Chat with Amit M. (Chief Growth Officer, Velbiom Probiotics), Swapnil (Head of Marketing, Pernod Ricard) and Abhishek (Co-Founder, GrowthX) on Building an Offline Strategy for D2C.

About the speakers

Amit M. (Chief Growth Officer, Velbiom Probiotics. Ex - ABinBev, Hector, SAB Miller)

As the CGO at Velbiom, Amit comes with 15 years of experience in P&L management, scaling businesses, and driving profitability in the retail and consumer goods space. After heading brand at SABMiller, Amit found his way to Hector Beverages where he led the Modern Trade charter to a 50 crore level from scratch. And not just that, he also made Paper Boat the highest growing juice brand in MT for 3 years. From there, he went on to lead the Business Vertical for Non-Alcohol Beverages at ABinBev.

Swapnil Kumar (Head of Marketing, Pernod Ricard. Ex - Ola, Royal Enfield, HUL)

A true teacher & mentor at heart, Swapnil comes with 20+ years of extensive experience across industries and companies. He's currently leading the Marketing charter at Pernod Ricard, a company that owns over 250 brands (name an alcohol brand, and you'll most likely find it there) He started off his career with a 13 year stint at HUL where he headed the Centre of operations and excellence, India & South Asia. From there, he became the Head of Marketing for Royal Enfield and Ola Electric. And, he's been a faculty member at MICA for the last 16 years!

Fun fact: Swapnil was a panelist for GrowthX's 15th Demo Day!

What did the session entail?

We hope you didn't miss this session because this was not your typical fireside chat. It was much more. Through these 90 minutes, Amit and Swapnil went super deep into cracking offline for D2C. They dived into how you can assess readiness and really nail partnerships and negotiations. It was a value-bomb for for folks looking to nail modern trade with solid cases and examples.

We had 3 solid outcomes from the session:

- Assessing readiness for modern trade and finding PMF with it.

- Nailing retail partnerships with nuances of entering the market and geography.

- Going about shelf space and placements.

And lastly, a QnA to wrap the session.

A sneak peak into the session 👇🏽

A deep-dive into the conversation

We will cover the above mentioned topics as we go through this doc. Grab a pen and paper, I’m sure you’d want to take notes.

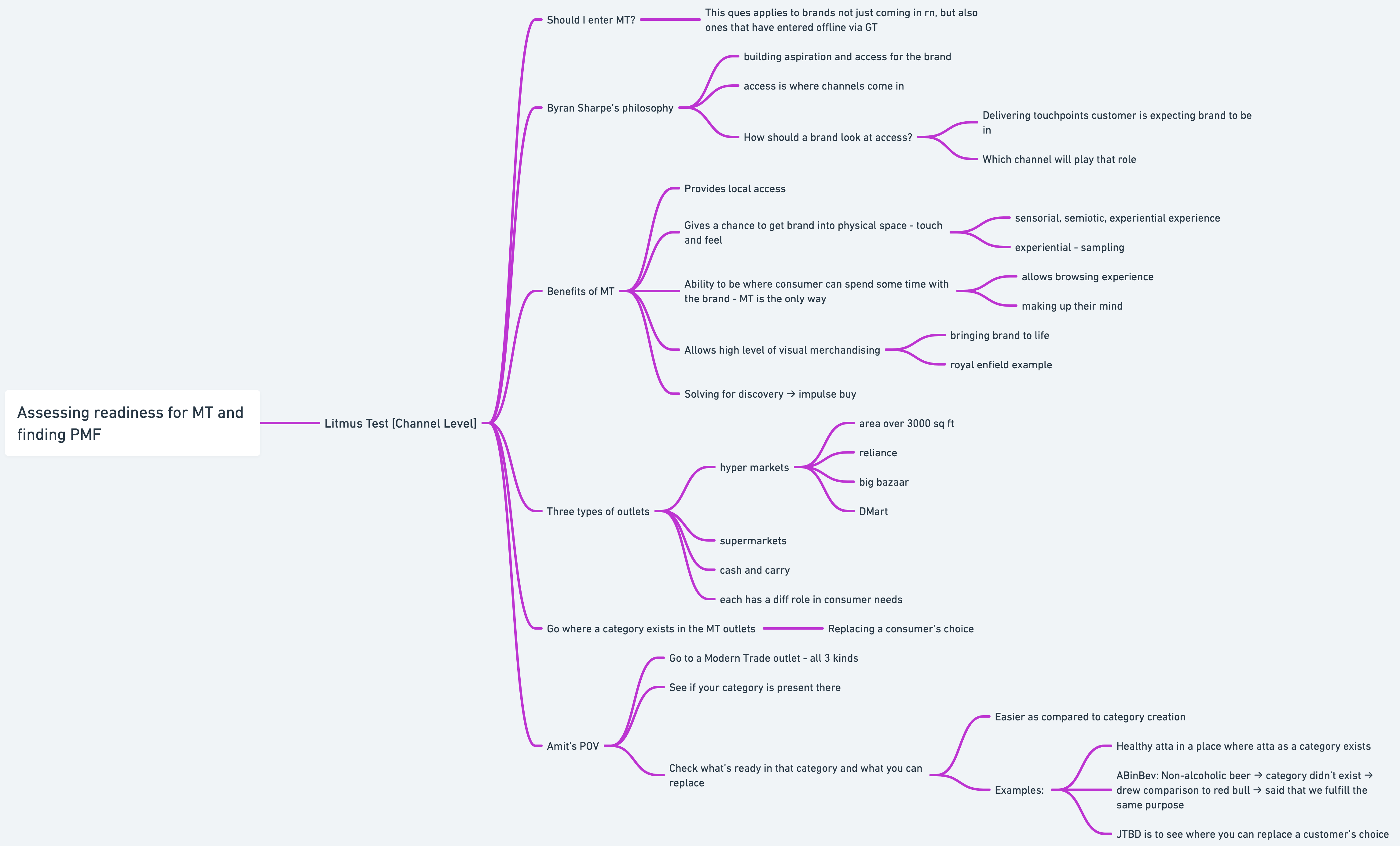

#1: Assessing readiness for MT and finding PMF

In the first section, Swapnil and Amit walked us through how you can figure if you're ready for modern trade, both at a channel and brand level. They also dived into what benefits and challenges MT brings with it and what process you can follow to get through this channel. Then we learnt how to solve for 2 business fundamentals linked to modern trade - Gross Margins and Delivery Timeline Readiness.

Assessing readiness at a Channel Level:

Key Nuggets 💎

- Start with the basics.

Ask yourself if being in MT will genuinely benefit your brand by fulfilling customer expectations. Are your customers likely to look for you in MT spaces? - Bryan Sharpe's Philosophy

It’s not just about access—it's about aspiration. Consumers expect brands to meet them halfway, and being in the right channels gives you a chance to turn “access” into a brand experience. - Why MT is Worth Exploring

MT provides local access, physical touchpoints, and experiential opportunities. These spaces let your brand come alive through sensory experiences, from touch and feel to sampling, which can be a game-changer for impulse purchases. - Know Your Spot

See how your product fits into MT categories. Instead of introducing a brand-new product type, think about how you could replace an existing choice. For example, placing a healthier atta option in the already established atta section could make it easier for consumers to try your product without disrupting their shopping flow.

Assessing readiness at a Brand Level:

How do you think through Gross Margins:

Key Nuggets 💎

- Margins you should aim for

For MT success, your gross margins ideally need to be above 60% to keep things sustainable, especially in the early years. Essentials like groceries might be lower, but categories like beauty or personal care often have higher margins. - What is GMROI and why you should care about it

Gross Margin Return on Inventory Investment helps you figure if your product will actually bring in revenue relative to the shelf space it occupies. This ratio can make your brand more attractive to retailers if your inventory is bringing in more revenue than the cost of the space.

Understanding and solving for delivery timeline readiness:

Key Nuggets 💎

- There are 2 Distribution Models

- Distribution Center (DC): Often prefered by smaller brands, these centers handle distribution but come with a slight fee.

- Direct Store Distribution (DSD): Typically used by bigger brands with more established logistics.

- Staying Fresh is super important.

Buyers want products with a longer shelf life, especially in categories like personal care. Time your inventory turnover with seasonal demand to keep your stock fresh. For example, Paper Boat aligns its runs with consumer mindsets, recognizing that customers avoid “last year’s stock” for perceived freshness.

#2: Nuances of entering the retail market

Next, we looked at how you can enter the retail space and prep for it by way of Sleepyowl's example. We looked at 4 different elements in it - SKUs to launch with, price point to keep, promotions to offer and building brand aspiration.

Sleepyowl Case Study

- SKU Strategy

Sleepy Owl should launch a cold coffee SKU tailored to DMart’s core demographic of lower-middle and middle-class consumers, who value affordable, branded choices. This adaptation is key to connecting with the audience and ensuring demand aligns with the product offering. - Sampling and Merchandising

Building buyer trust requires on-ground promotions—sampling and strategic merchandising increase product movement and enhance consumer familiarity with the brand. - Value focused Market

Indian consumers are highly value-conscious, especially in MT. DMart, for example, appeals to the bulk-buying mentality, where consumers expect cost savings through bulk purchases or bundled discounts. - Adapting to regional markets

Tailoring pack sizes and promotions to regional shopping behavior is critical. For instance, smaller packs might work well in UP, while larger packs suit Punjab’s market.

Cracking outbound as a lesser known brand in DMart:

- Start Small, Build Trust

For smaller brands, a direct approach to MT players like DMart can work wonders. An example is Rajam snacks, which built a relationship with DMart by showcasing their handmade, high-quality snack products. By pitching unique value (handmade, pure ingredients), they grew a substantial MT presence, generating close to 100 crores from DMart alone. - Warm Introductions and Sample Sharing

Getting an introduction to a category manager, often through mutual connections, can open doors. Always carry samples to present to potential buyers. - Regional vs. Central Teams

For brands new to MT, regional players in the chain might be more accessible than central teams at headquarters. Regional teams often have more autonomy and are eager to create their mark, providing a more viable entry point without requiring substantial fees. - Buyer’s Perspective

Understand the pain points of category managers. For instance, they prioritise high fill rates to maximize revenue per square foot. Propose SKUs that address low-fill-rate areas to solve inventory gaps. Distribution partners can often help gauge where your product could best support these fill rates, increasing your appeal to buyers.

Geography

#3: Nailing shelf space and placements for MT

Finally, Amit and Swapnil shared goldmine of insights on how to nail placement and how consumer behaviour plays a massive role in it. We looked at the best places to bag for your product and how investment in extra shelf space creates a difference.

- Primary Bay

Place products in the main aisle with related items (e.g., a new toothpaste with ones) to ensure visibility in high-traffic, relevant zones where customers are looking. - Shelf Position

Avoid the bottom shelf (often overlooked) and aim for eye-level shelves or even the top for premium visibility. Left-to-right shelf positioning also matters as shoppers tend to scan in this direction, making the left side more valuable. - Traffic Flow

Align products with traffic patterns; for example, a new toothpaste brand benefits from being on the left side of established brands like Colgate to capture attention. Larger SKUs typically go on the left, and smaller ones on the right, supporting flow and visibility.

Investing in Shelf Space - Temporary Expansion

In the early stages, it’s beneficial to pay for extra space to give the brand a larger perceived presence, which can boost customer confidence and perceived quality. - Building Presence Without Fees

Amit shared how Paperboat didn't pay for space but focused on solid merchandising. They had dedicated merchandisers to restock directly from warehouses to shelves, ensuring consistent and visible presence. - Major chains (e.g., DMart, Reliance) often ask smaller brands to hire exclusive merchandisers. Investing in this can yield stronger relationships and better placement outcomes.

- Try being a category captain. For example, Redbull proposing to be a category captain and assuring the buyer that they'll help in the growth of the overall category for drinks like Sting, Monster and the likes. This can help with getting better shelf placements.

Link to the complete whimsical here

100+ members joined in, across 3 to 10+ years of experience, here’s what they had to say about the session!

Loved the nuances of Customer behavior across various store formats and perceived value at different type of stores.

Sandeep Nayanipatti

GX 20

Amit and Swapnil’s interesting and amazing insightful session takeaway had a bunch of actionable thoughts for product managers when it comes to thinking around MT without compromising PMF. I now will look at things in different lenses because of that big impact that is thought process gone for placement. And I liked the focus on the panel about retail partnerships and negotiation that would encourage long term growth.

Prathyusha Gaddalay

GX 22

Learnt so much about a very new topic for me. Amazing insights & details. Can't wait to apply the knowledge soon.

Animisha Dalal

GX 22

The insights which the speakers shared are like insider information; gems.

Siddhant Mishra

GX 21

We hope you found value in this one. Now that you've gained momentum, check out these resources to continue your learning streak:

Happy learning! See you in the next one :)

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.